Towson Hotel will be an important hospitality component of the planned Towson Row development.

FOR IMMEDIATE RELEASE

February 17, 2021

The MD-PACE Program is pleased to announce the approval of C-PACE financing for the construction of a 220-room dual branded Hampton Inn & Home2 Suites hotel in Baltimore County’s Towson, MD. Greenworks Lending, a leading C-PACE lender, provided the financing for this project. This dual branded hotel is part of the planned Towson Row development, which will include 150,0000 square feet of office space, 75,000 square feet of restaurant & retail space, 720 student beds, and 220 apartments.

The owner of Towson Hotel will access $2,500,000 of C-PACE financing in order to install efficient PATC and VTAC equipment for the property; these measures will reduce utility costs and ensure customer comfort by easily regulating heating and cooling in their rooms and throughout the property. For a hospitality asset, the importance of interior climate and customer satisfaction is extremely important. Through innovative design and commitment to sustainable principles, this project received a National Green Building (NGBS) Silver certification.

Michael Billingsley, Mid-Atlantic Director for Greenworks Lending, described the project as a “great example of the intersection between sustainable investing and economic development.” He went on to say that “this modern Hampton Inn & Home2 Suites will be an attractive option for the community and travelers, due to its modern offering and access to a wide range of services through the larger Towson Row complex. We congratulate Shamin Hotels and look forward to continuing our partnership on future projects throughout the Mid-Atlantic.” Neil Amin, CEO of Shamin Hotels, said of the deal closing, “It was a pleasure working with the Greenworks team to develop a tailored solution that enabled us to monetize the energy efficient improvements that were designed into this NGBS Silver project. We look forward to working with them on future projects.”

The COVID-19 pandemic significantly affected the hospitality industry in particular. The COVID-19 pandemic ushered in a global recession and the resulting travel bans reduced the demand for lodging. These trends are both slowly reversing. While the hospitality industry waits patiently for demand to return to pre-COVID-19 levels, many in the industry have decided to complete cost-saving capital expenditure projects or larger Property Improvement Plans (PIPs) to better position their hotels for the future. Funding a portion of these expenditures with C-PACE financing creates a strong value proposition as the zero down, extended loan terms often lead to the annual debt service being lower than the annual energy savings, creating a cash-flow positive project from day 1; alternatively, C-PACE can replace more expensive mezzanine or preferred equity financing in a capital stack to increase returns on new developments.

The MD-PACE program encourages all commercial property owners and developers with interest in accessing C-PACE financing or investing in high-efficiency improvements to contact info@pacefinancialservicing.com.

This press release was updated on 2/18/21 to incorporate the quote from Neil Amin.

About the MD-PACE Program

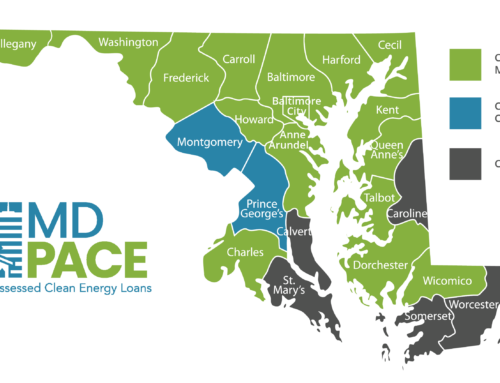

The MD-PACE program is sponsored by the Maryland Clean Energy Center (MCEC), a corporate instrumentality of the state of Maryland which advances the adoption of clean energy, energy efficiency products, services and technologies. MCEC leverages private capital to help homeowners, businesses, and government entities reduce energy costs. The MD-PACE program offers C-PACE financing to commercial property owners statewide.

About Greenworks Lending:

Greenworks Lending is the largest provider of Commercial Property Assessed Clean Energy (C-PACE) financing in the country. Led by several of the industry’s founding policy developers and standard-setters, Greenworks Lending is a private capital provider uniquely dedicated to funding commercial real estate through C-PACE. Greenworks has provided financing to hundreds of commercial properties and is active in 25 states. Greenworks Lending’s C-PACE financing makes clean energy a smart financial decision for commercial property owners.